Clarity Year-End - 2021

It is that time of the year again to perform our year-end procedures. We have

accumulated several documents and resources to assist you in your year-end

processing. Please utilize the resources listed to the right to assist in

stepping through the procedures needed to close out your year-end in Accounts

Payable, General Ledger, and Payroll.

We recommend that steps 1-16 found on pages 5-34 of the

Payroll

Year-end Procedure Guide

be completed before your first payroll of 2022. However, the most import things to complete are any changes to rates such as

federal and state withholding, retirement, and health insurance as required prior to the first payroll (see the

Tax Rate Changes

document on the right). DO NOT change the maximum wage amounts for social secuirty before W-2's are calculated.

Instructions on Downloading and Importing the Steps

Checklists

There are electronic steps checklists available for you to import into Clarity

to help you through the year-end procedures. To import a checklist, follow these

steps:

-

On the right side of this screen, there is a section title Steps Checklist.

Right-click on the appropriate steps checklist (i.e. General Ledger, Accounts Payable, or Payroll).

- Select Save target as...

- Save the file to a location on your computer or network.

- If the Download complete screen appears, click Close.

- Open the Clarity program.

-

Move your mouse's arrow to the Checklist on the right side of the screen so that it

slides out.

-

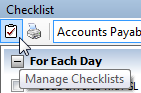

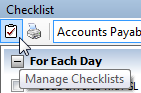

Click the Manage Checklists button (clipboard with a checkmark).

-

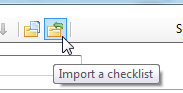

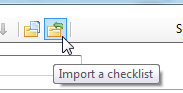

Click the Import a Checklist button (yellow folder with an arrow going into the

folder).

-

Navigate to the file saved in step 3 above. Click

Open.

-

Click on the new checklist that was imported on the left of the screen. You may have to scroll to the bottom.

*Note: If there was a year-end checklist that was imported in years past,

the new checklist may be named with a number after it (e.g. Payroll Year-end 1)

-

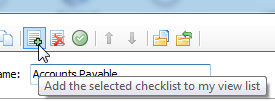

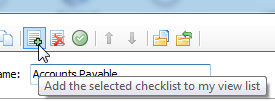

Click the Add the selected checklist to my view list button (lines on a white

paper with a green plus).

- Click OK.

The checklist should now be listed in the drop-down.

IMPORTANT: If you ordered blank 4-up W-2 stock

If you chose to utilize the blank 4-up W-2 form, a change is needed on the form

before you print your W-2's. We need to change the year from 2020 to

2021.

Follow these steps to make that change:

- In Clarity, go to Payroll.

- Click on W-2 and 1099 Reporting.

- Click on Forms.

- Select Form W-2 and click Accept.

-

Select the W-2 4-Up Form [Caselle Master] or the

W-2 4-Up Form with Instructions

[Caselle Master]

depending upon which type of form you ordered.

- Click Open.

There are four (4) instances where 2020 appears. We need to change this to

2021.

- Right-click on the first instance of 2020 that you see.

- Click on Settings.

- Change 2020 to 2021.

- Click Accept.

- Repeat steps 7-10 for the other three (3) instances.

- Click the blue Save button on the toolbar.

- Type in a name for the new form (e.g. W-2 4-Up Form).

- Click Save.

|